Vehicle registration duty gst

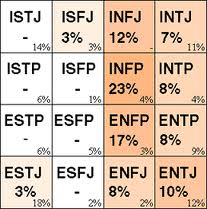

For more information, see Trade-ins. What is a GST registration? Do you pay GST on leased vehicles? Do I have to claim a GST on a car? GST on cars in India is applicable across multiple slab rates of , , and. The most relevant GST rate on cars is that applies to motor vehicles including those for personal as well as commercial use. Vehicle registration duty is imposed on the dutiable value of the vehicle. There are rules concerning luxury car purchases, leased vehicles and purchasing second-hand. Generally, only the TAC charge line item includes GST , whereas the registration fee and Insurance Duty do not contain GST. Given the requirements necessary for an expense to be claimable, only the TAC Charge passes all tests and should be included on the Airtax BAS. Estimate how much vehicle registration duty you will pay. Figures are rounded up to the nearest $100. Goods And Services Tax. The controlling factor is the invoice. When a vehicle is registere a registration numb...