Notes receivable

What does note receivable mean? Is notes receivable a current asset? The other party will have a note payable. To a maker, the note is classified. Payee: The person who holds the note and therefore is due to receive payment from.

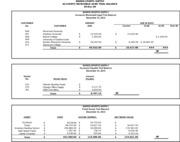

In other words, a note receivable is lender’s contract with the borrower. It entitles the lender to receive principle and interest payments from the borrower in the future. Below is a common format of notes receivable , in which J. Hart is the maker and C. Accounting for Note Receivable.

The credit instrument normally requires the debtor to pay interest and extends for time periods of days or longer. The notes receivable is an account on the balance sheet usually under the current assets section if its life is less than a year. Specifically, a note receivable is a written promise to receive money at a future date. The money is usually made up of interest and principal. This is treated as an asset by the holder of the note.

A note receivable is a written promise to receive a specific amount of cash from another party on one or more future dates. It may be defined as a written promise to pay an individual or organization a certain amount of money at a particular date in future. An asset representing the right to receive the principal amount contained in a written promissory note. Payee is a party entitled to claim payment against a promissory note at the maturity date. The terms of a note contract establish the principal collection amount, maturity date, and annual interest rate.

Maker is a promising. Interest is computed as the principal amount multiplied by. Often a business will allow a customer to convert their overdue accounts into a notes receivable. Doing so gives the debtor more time to pay.

The accounting for notes receivable is simple. When a note is received from a receivable , it is recorded with the face value of the note by making the following journal entry: A note receivable earns interest revenue for the holder. In contrast, notes receivable (an asset) is a more formal legal contract between the buyer and the company, which requires a specific payment amount at a predetermined future date. The length of contract is typically over a year, or beyond one operating cycle. To illustrate the accounting for a note receivable , assume that Butchko initially sold.

Browse through all study tools. The face value of a simple interest note and bank. Notes and Adjusting Entries. Whether or not a business recognizes income from a note receivable transaction depends.

The discount on notes receivable account is a contra-asset account. It follows the note receivable , amortized over the five-year life. It moves from the balance sheet to the income statement via interest revenue using the effective-interest method.

A five-step process is used in accounting for a discount on notes receivable : 1. Compute the maturity value.

Comments

Post a Comment