How to change address on tax return

How do you change your address with the IRS? How to change a business address with the IRS? To sign in you need a Government Gateway user ID and password. If you do not have a user ID you can create one when you update your address. Change of name or address How you contact HM Revenue and Customs ( HMRC ) to update your name or address depends on your situation.

You’ll also need to change your business records if you run a. From posting to a desk about one week. Request for cancellation and re-issue sent in that day. They take about weeks from send to permission back to re-issue. The reasons were listed on the notice of coding - read the letter you got.

At a guess the 102L was an error and you overpaid tax in an earlier year. The high code is returning an overpayment through your wages. In the UK you are eligable to pay council tax, each year the council sends out a registration form to every address in the borough.

You will probably see. Every member of the household aged or over must be entered onto the form and this is returned in a. Online tax returns. Sign in using your Government Gateway user ID and password.

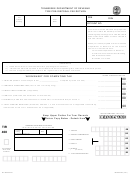

From ‘Your tax account ’, choose ’Self Assessment account ’ (if you do not see this, skip this step). Choose ‘More Self Assessment details’. IRS Change of Address If you move or otherwise change your address , you should make sure to notify the IRS. This IRS change of address form is used for individual tax returns as well as gift, estate, or generation-skipping transfer tax returns. For changes of address relating to an employment tax return , we issue confirmation notices (Notices 148A and 148B) for the change to both the new and former address.

It can generally take four to six weeks after receipt for a change of address request to fully process. Notification of Change of Postal Address. By writing a letter to the IRD. By completing the Tax Return – Individuals.

By notification through GovHK. If you’ve made a mistake on your Self Assessment tax return , you can make an amendment or correction. My new address (and old) is international. Does this impact the process?

If you have already e-filed your federal tax return and it is pending or accepted you cannot update it with your tax return you will need to notify the IRS. If you had a balance due, the IRS will issue a check to the address on your return. If it is not deliverable to that address , the check will be returned to the IRS. One can apply for a KRA pin number, file annual tax returns as well as apply for compliance certificate all on the iTax portal.

To change your physical or mailing address , complete Form DTF-9 Report of Address Change for Business Tax Accounts. To change any other business tax account information (as well as your address ), file Form DTF-9 Business Tax Account Update. To report a completed change of entity, call the Business Tax Information Center. If you have reason to believe that your identity, address , tax file number (TFN) or other details are being used fraudulently, you can report it to us.

There are various ways to update your details if they are incorrect or they have changed.

Comments

Post a Comment